🚨 JUST IN: Canada’s U.S. alcohol crackdown sends bourbon exports into freefall — and Kentucky producers are bracing for disaster ⚡.CT

For generations, U.S. leaders treated Canada like the “safe” neighbor — a market that would always stay friendly, always stay open, always keep buying. That assumption just blew up in real time, and the fallout is landing hardest in one of America’s most iconic industries: whiskey and bourbon.

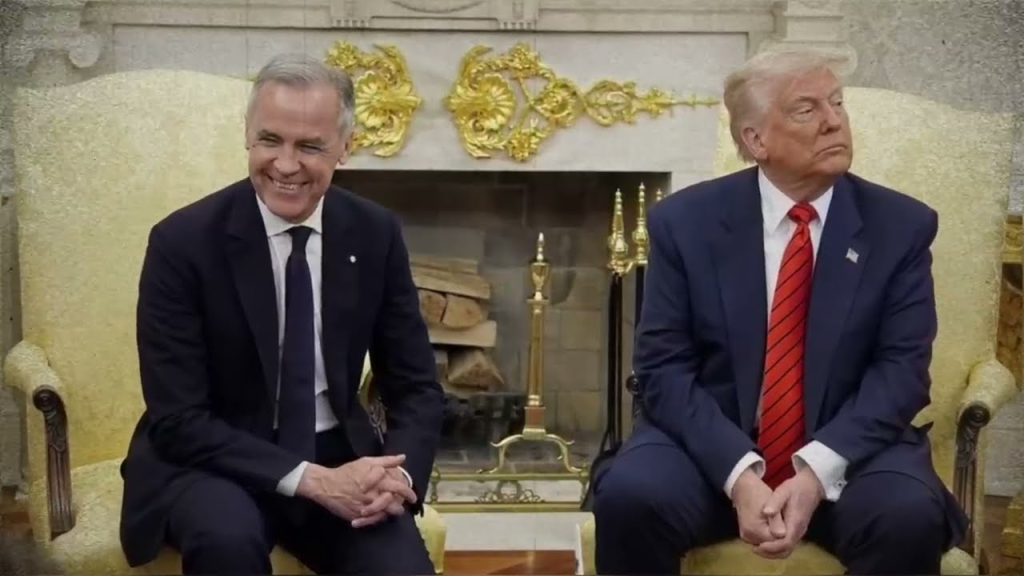

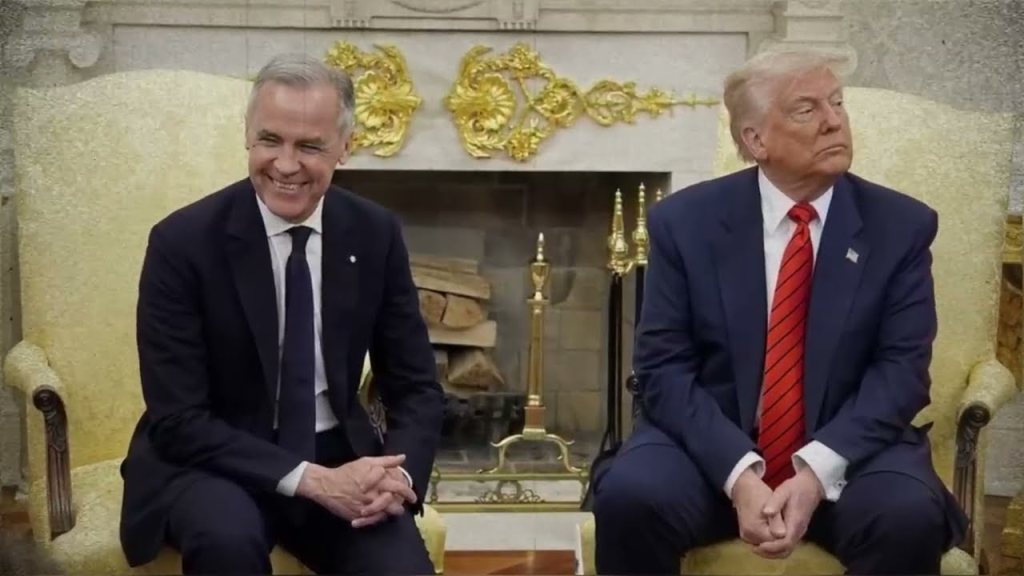

It started with a trade fight. In March 2025, U.S. tariffs under President Donald Trump triggered swift retaliation and a political storm across the border. But what happened next wasn’t just government policy — it turned into a public, shelf-by-shelf consumer revolt.

Across multiple Canadian provinces, U.S. alcohol was halted, removed, or blocked from import. In places where provincial liquor agencies control major retail distribution, that’s not a symbolic protest. That’s a kill switch.

And the numbers got ugly fast.

Business Insider reported U.S. liquor exports to Canada dropped 85% in Q2 2025, hammering American distillers — especially Kentucky, which produces most of the world’s bourbon. The Wall Street Journal described the situation as a full-blown headache for U.S. liquor and winemakers as Canada’s restrictions squeezed a critical export market.

In Canada, the mess became so big that provinces started asking a wild question: What do we even do with all this U.S. booze sitting in storage?

Ontario reportedly held inventory worth about C$80 million while other provinces explored reselling stockpiles or directing proceeds to food banks and charities. That’s not a small diplomatic spat — that’s a trade rupture with real money and real jobs attached.

So why did the backlash get so intense?

Part of it is that Canadians didn’t just see tariffs as economics — they saw them as disrespect. Trump repeatedly floated the idea that Canada should become the 51st U.S. state, a line that fed public anger during a period of trade tension. Whether that was “serious” or not almost doesn’t matter.

What mattered was the reaction: Canadian consumers, and the provincial systems that control shelf space, responded like they’d been dared.

And once a product loses shelf space, it loses something harder to win back: habit.

Industry leaders have warned that removing products from shelves is “worse than a tariff” because it wipes out sales instantly — not slowly, not hypothetically, but immediately.

That’s why Kentucky’s bourbon ecosystem is feeling cornered. It isn’t just distilleries. It’s glass, labels, trucking, tourism, hospitality, and the long supply chain that turns corn into one of America’s biggest cultural exports.

When exports collapse, distilleries don’t just lose revenue — they cut production plans, delay expansion, and reduce shifts. And in an industry where cash flow depends on aging inventories and long timelines, prolonged shocks can push weaker players toward crisis.

The scariest part for U.S. producers is what Canada is doing while America scrambles: building alternatives. The longer U.S. brands stay off shelves, the more room opens for Canadian spirits and non-U.S. imports to take their place — and the more “normal” it becomes for shoppers to reach for something else.

That’s the quiet danger Washington underestimated: this isn’t only about a tariff cycle. It’s about consumer rewiring.

Canada is the United States’ largest export market in general, and officials on both sides have acknowledged how deeply intertwined the relationship is. When that trust cracks, the ripple effects don’t stay in one aisle of one store. They move through ports, warehouses, farms, and factory towns.

And now the bourbon belt is learning a brutal lesson: if Canada decides the relationship isn’t “automatic” anymore, American industries that treated it as guaranteed can find themselves fighting for survival — one empty shelf at a time.